Almost as soon as Treasury Secretary Henry PAULSON opened his mouth this afternoon - the already shaky market started to tank. GE was one of his casualties - despite it being known that GE Financial would tap the Fed's TARP.

Risible, but Paulson now intends to "rescue" consumer finance companies like GM Acceptance (now owned by GE Financial) and VISA from their car loans credit card debts? This is beyond belief.

Markets are holding their breath in anticipation of G20 meeting in Washington DC this weekend Nov 15. Results expected - zilch. For the record, Mr Bean is a respected authority on banking and credit - here were his comments a few week ago when the crisis broke.

Coal + Oil melts Canadian Markets

Canadian stocks were obsessing about the meltdown of Teck Cominco - dn 24% to $C6.63 and change, but oil stocks were also responding to failing price of crude despite last weeks comments by IEA.

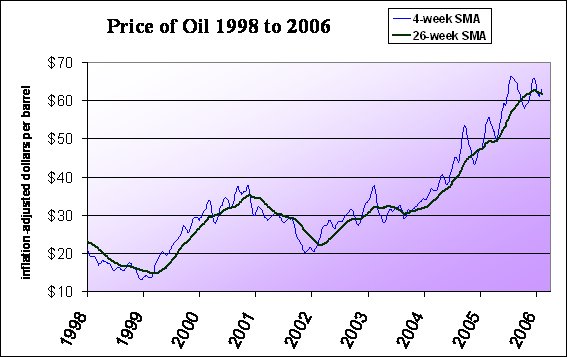

Those gloomy projections were dismissed by OPEC at conference in London UK today. OPEC holds alot of sway in the marketplace and many hope they will save us from ourselves and cut back on production. I suspect this may be false hope or wildly misplaced optimism as I am reminded here that the last time OPEC attempted to "calm" the market was April 1998, when cuts of 1.8 million barrels a day were proudly announced. From that point, the crude price continued to fall for another 14 months, slumping by a further 32 per cent and breaking US$10. The "usual suspects" with OPEC (Venezuela, Libya, Iraq and Nigeria) could not be trusted to keep there word and leaks were rampant. Let us hope for more solidarity this time around.

[Update: Thursday Nov 20, 2008 was another brutal meltdown S&P500 752 dn 54 and TSX Comp 7724 dn 765 and WTI US$40.42 dn 5. The VIX was 80.86 up 6.6. For reference, the meltdown last week on Wednesday Nov 12 the S&P500 closed 852 dn 46 and TSX Comp 8922 dn 502 and WTI was $59]

No comments:

Post a Comment